Introduction

At this past year’s COP26, new financial pledges were made to support adaptation and mitigation strategies in developing countries as they continue to be among the most threatened nations in the wake of climate change. With the Covid-19 pandemic nearly paralyzing the most critical sectors of Small Island Developing States (SIDS) economies for the last two years, the climate crisis has shown zero signs of a standstill. Thus, as SIDS economies continue to recover from the devastation of the pandemic, the need to prioritize climate financing on global agendas is critical.

Defining Climate Financing

Finance is among the utmost valuable assets in the global response to climate change. Without finance, SIDS are left with limited financial resources and capacities to build resiliency and protect against the escalating threats of the international climate crisis.

While there is no universal and internationally acknowledged definition of climate financing, experts and policymakers have indicated that the meaning of climate finance is continually evolving, and captures the following aspects:

- Financial support for mitigation and adaptation activities, including capacity building and R&D, as well as broader efforts to enable the transition towards low-carbon, climate-resilient development

- Financial flows from developed to developing countries (North-South)

- Financial flows from developing to developing countries (South-South)

- Financial flows from developed to developed countries (North-North)

- Domestic climate finance flows in developed and developing countries

- Public, private, and public-private flows

- Gross flows and net flows that shed light on the level of mobilized international investments and the net contribution of countries

In essence, climate financing refers to financing that seeks to support mitigation and adaptation actions to address climate change.

The Dimensions of Climate Financing

Climate financing is a multidimensional process encompassing various forms of financial flows and processes which make it possible.

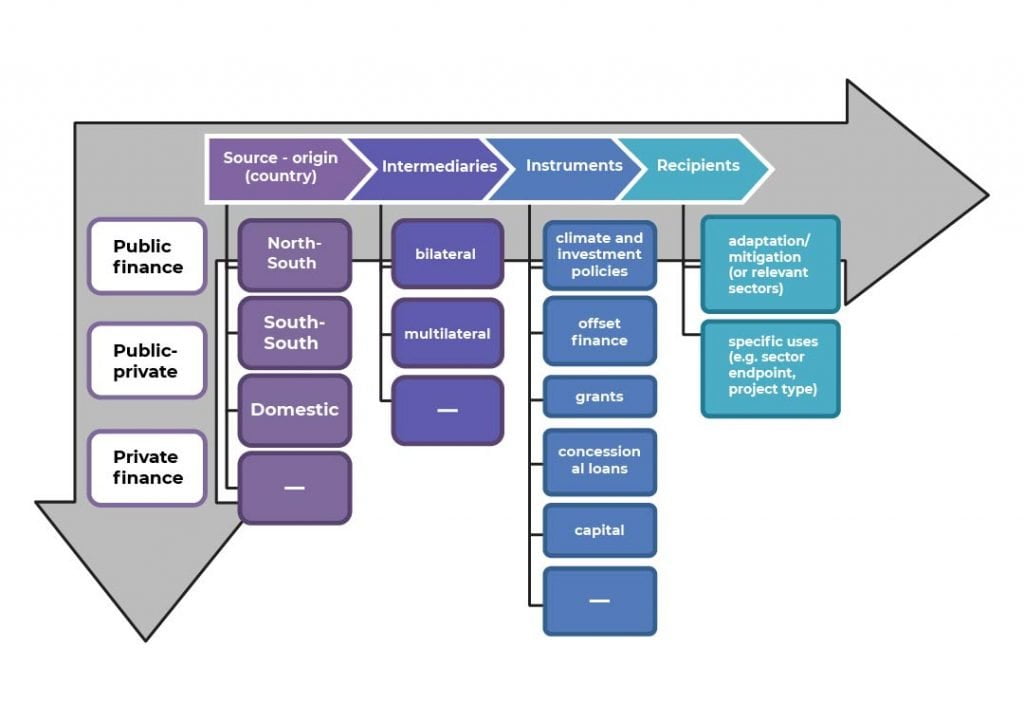

The above graph provides a visual interpretation of climate finance from a two-dimensional perspective. The horizontal dimension represents the supply chain of climate finance, entailing how financing flows from the primary source(s) to the final use of funds, while the vertical dimension describes the types of financial flows and intermediaries that are being used.

Climate financing does not always have to occur at the national and international levels, domestic and community financing can be viable options for many climate change adaptation projects. However, it is unlikely that any single source of financing can fulfill all the adaptation needs of a community. Climate financing requires sourcing from a variety of different sectors, international cooperation, and multilateral agreements.

Why SIDS Need Climate Financing

The geography of islands makes them highly susceptible and vulnerable to factors such as sea level rises, changes in marine resources and biodiversity, as well as increases in extreme weather events, such as the Super Typhoon that hit the Siargao Islands in late December.

SIDS especially are caught in a cruel paradox when it comes to tackling climate change: collectively, they emit less than one percent of global carbon emissions, yet they are disproportionately exposed and affected by the effects of the ongoing climate crisis.

To add to these challenges, SIDS have relatively small and fragile economies that often depend on tourism, which accounts for approximately 30% of their gross domestic product (GDP). The Covid-19 pandemic with subsequent travel restrictions and lockdowns has created further challenges for island economies to repay debts and finance projects in climate adaptation and mitigation. If SIDS are to recover from the fiscal shocks of the global pandemic and protect against future combinations of climate change, then changes at the international level are essential.

Finding Solutions for SIDS

The latest report issued by the Intergovernmental Panel on Climate Change (IPCC) suggests that although global tracked climate finance has shown an upward trend in recent years, current global financial flows for climate adaptation and mitigation are insufficient for and constraints implementation of climate resiliency projects, especially in developing countries.

To add to these challenges, SIDS have relatively small and fragile economies that often depend on tourism, which accounts for approximately 30% of their gross domestic product (GDP). The Covid-19 pandemic with subsequent travel restrictions and lockdowns has created further challenges for island economies to repay debts and finance projects in climate adaptation and mitigation. If SIDS are to recover from the fiscal shocks of the global pandemic and protect against future combinations of climate change, then changes at the international level are essential.

Developed Countries Repaying a Historic Climate Debt

For decades, international conventions, such as the Kyoto Protocol and Paris Agreement, have been calling for parties with more financial resources, such as the industrialized developed states, to increase the availability and access to financial resources for climate mitigation and adaptation for those who are less endowed and more vulnerable. It is necessary for the international community and those who are responsible for the world’s largest emissions to step up and repay a historic climate debt for a crisis they have exacerbated. The early industrialization of the world’s richest countries granted them economic prosperity at the cost of significant carbon emissions that now threaten the livelihoods and survival of developing nations.

At the 2015 Copenhagen Climate Summit, developed nations pledged to channel US$100 billion annually to developing countries for climate change mitigation and adaptation. However, at COP26, this promise was proven to have been broken and has pressured developed states to make new commitments in climate financing to entities such as the Adaptation Fund and the Least Developed Countries Fund. It is still too early to determine whether these pledges have come to fruition, nonetheless, financial contributions from developed and industrialized countries are a key component to ensuring the survival of SIDS in the face of the climate crisis.

Debt-Swaps as an Alternative Source of Climate Financing

While increased investment and financial contributions from developed countries may present as the most apparent source of climate financing for SIDS, there are alternative and innovative solutions being tested to assist SIDS in financing climate adaptation and mitigation. Debt-for-climate swap is a mechanism that consists of bilateral or multilateral debt being forgiven by creditors in exchange for commitments by the debtor to use outstanding debt service payments for national climate mitigation and adaptation projects. Experts have suggested that debt-swaps could be especially beneficial for Caribbean SIDS, as they are among the most heavily indebted per capita countries that face regular challenges with low and stagnated growth, high public debt, and vulnerabilities to climate change.

Blended Financing

Traditionally, public sources, such as those from multilateral organizations, government, aid agencies, and international development banks, have been the main capital source for climate financing. The financial capital needed to adequately address climate change mitigation and adaptation supersedes the amount of public funding available, thus, there is an increase in demand for funding from private sources, such as commercial financial institutions, philanthropists, and corporate actors. This mix of public and private financial resources constitutes a form of blended climate financing. With greater sources of financing options available, SIDS will have a better chance of implementing projects necessary to combat the adverse effects of climate change. For example, the Green Climate Fund (GCF), which provides finance to developing countries to help them fulfill plans for climate adaptation and mitigation, incorporates the public sector via mechanisms such as sovereign loans lent through development banks and promotes private sector investment through concessional instruments, including low-interest and long-term project loans, lines of credit to banks and other financial institutions, equity investments, and grant-based capacity-building programs. Currently, the GCF Global Portfolio has funded approximately US$1.2 billion worth of projects in SIDS including the establishment of the Caribbean’s first-ever green bond exchange and financing climate-resilient urban water infrastructure in Fiji. Read more about these case studies here.

Conclusion

The diversification of climate financing is a great step for fostering more resilient and adaptive SIDS. However, as we have learned from the deliberations at COP26 and the latest IPCC report, we are still facing an immense deficit in the finance needed to adequately address the threats of climate change, especially in the island communities most vulnerable. At this year’s Island Finance Forum, we have designated one of our six content tracks to climate financing. Our goal is to engage our network of global island stakeholders to learn from experts in the field, discuss best practices, and engage in meaningful dialogue so that we can best address the challenges facing islands globally.

To add to these challenges, SIDS have relatively small and fragile economies that often depend on tourism, which accounts for approximately 30% of their gross domestic product (GDP). The Covid-19 pandemic with subsequent travel restrictions and lockdowns has created further challenges for island economies to repay debts and finance projects in climate adaptation and mitigation. If SIDS are to recover from the fiscal shocks of the global pandemic and protect against future combinations of climate change, then changes at the international level are essential.